FEES paid to external consultants by Frankston Council have soared by $500,000 per year without explanation.

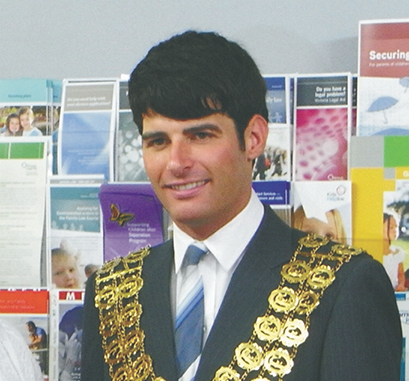

Former Frankston councillor and mayor Kris Bolam says he is concerned about “wasteful spending” on external consultants at the same time as overall staff pay and costs have risen by $1.5 million per year since council’s 2014 budget.

Mr Bolam, mayor in 2011, obtained the information about rising consultancy fees under freedom of information laws. The former councillor said council “is treating the public purse like monopoly money” despite crying poor over state government rate capping.

“There is a staff knowledge deficit within the council and the organisation has an overreliance on external consultants while enormous sums are being spent on staff learning and development courses,” he said.

Mr Bolam said it had taken several months for council to compile and release the latest breakdown available, according to council, of consultancy fees and staff costs.

Figures supplied to Mr Bolam reveal payments to outside consultants jumped from $1.2 million in 2009 to $1.7 million in 2013.

The Times has sought an explanation from council for the rising consultancy fees and staff costs for more than a month before publication.

Mr Bolam said employee pay, superannuation costs and employee development course fees are “putting an enormous strain on the council budget”.

He criticised the “out of touch” salaries awarded to senior staff. Senior management are paid up to $254,000 per year.

Council CEO Dennis Hovenden’s annual remuneration was increased by 10 per cent last year to $325,000 (‘Longer stay for CEO under contract plan’, The Times 25/5/15).

Mr Bolam says “a wide-ranging forensic audit of council expenditure” should be carried out and councillors should be regularly notified of consultancy spending by individual council departments.

“It is absolutely doable but what is lacking from this council is the necessary leadership and will to make it happen,” Mr Bolam said.

Frankston mayor Cr James Dooley has highlighted council’s “prudential financial management” as a factor in keeping overall rate rises for the upcoming 2016-17 financial year under the Labor state government’s mandated rate cap of 2.5 per cent based on inflation.